Table of Content

Generally, if you receive a W-2 statement showing wages paid and taxes withheld, you are considered an employee. If you get a 1099-Misc reporting earnings, you are considered an independent contractor, which allows you to claim work from home expenses. Before 2017 and the Tax Cuts and Jobs Act, it was much easier to deduct home office expenses.

Employers may be able to reimburse employees for necessary expenses and then deduct the outlays as business costs. Due to the Tax Cuts and Jobs Act of 2017 put in place by Trump, home office expenses are no longer deductible for employees. This commenced as of 2018, so home office tax deduction 2020 and onwards won’t be eligible, even with covid-19. Before this Act, employees could claim deductions for unreimbursed employee business expenses, such as home office furnishings like desks, chairs, and printers.

Support

This exception also applies to advisers, directors and assistants. The mansion is Hébert's home, where he's raising his 5-year-old son, Romeo, as well as a showroom for his antiques business. He also rents the space out for $184 an hour for photographers and videographers looking to take advantage of its evocative interiors. The renovation has been a labor of love that's won him praise across the internet, where he's drawn adoring fans. On Instagram, nearly 10,000 people follow Manoir Blackswan — what he calls the mansion — and 13,700 people follow his antiques business. On Facebook, he's won a devoted audience both on his personal page and in a group for moody maximalist interior design, which has 287,000 devoted members.

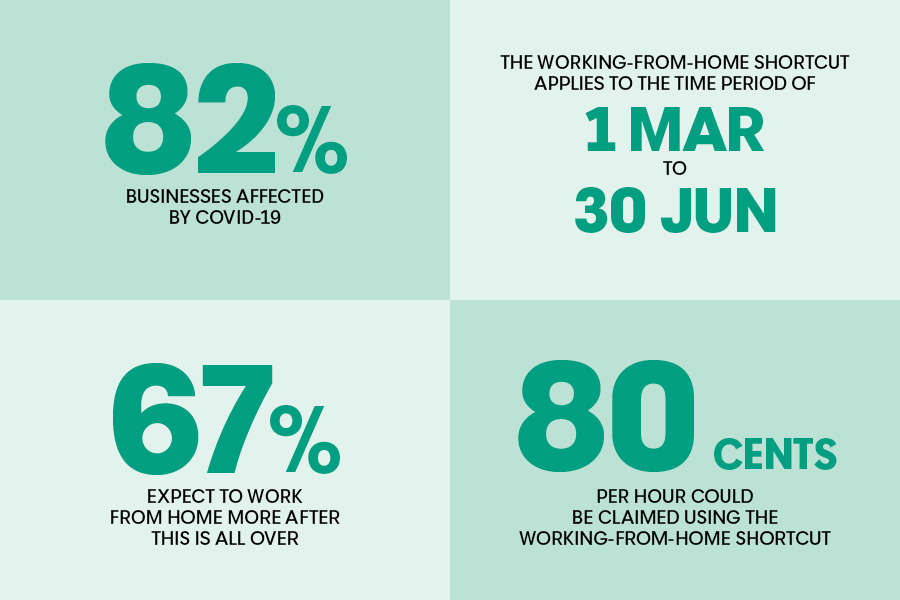

This also applies to married couples filing their taxes separately this year. The easy method simply involves multiplying $5 by the square footage of your home office space, up to a maximum of 300 square feet. For example, if your home office is 10 feet by 20 feet , then your home office deduction using the simplified method would be $1,000. Monthly stipends are included in employee W-2 wages and paystubs as part of their income, so this makes the amount tax-deductible for the employer, but also makes the amount taxable for the employee. If you need paystub created, be sure to check out the paystub maker. Most employers have shut down their offices and asked their workers to start working remotely instead - which has contributed to the rise of home offices and individuals working from home.

Tips for Work From Home Tax Deductions LegalZoom

However, certain groups of employees may still benefit from these deductions. And independent independent contractors can still deduct expenses for home offices. Employers may be able to reimburse employees for necessary expenses and then deduct the expenses as business costs. Your home office should also be used exclusively and regularly as a place to meet with customers and clients if you want to claim for work from home tax deductions.

You must also meet what’s called "the 2% floor." That is, the total of the expenses you deduct must be greater than 2% of your adjusted gross income, and you can deduct only the expenses over that amount. One of the most common homeowner tax deductions is mortgage interest. If you are paying interest on a mortgage, then you will likely be able to deduct that interest on up to $1 million dollars in loan value on your first and/or second home. Using the regular method, qualifying taxpayers compute the business use of home deduction by dividing expenses of operating the home between personal and business use. Self-employed taxpayers filing IRS Schedule C, Profit or Loss from Business first figure this deduction on Form 8829, Expenses for Business Use of Your Home.

Qualifying for a deduction

Two of the most common work from home tax deductions are the home office deduction and the mileage deduction. This is for overseas Americans living and working outside of the U.S. There are three things an individual needs to do in order to qualify. First is by filing a tax return, second is by living and working abroad or outside the country, and third is for the individual to be in a foreign country for 330 days in any 365 day period.

Retirement Investments does attempt to take a reasonable and good faith approach to maintaining objectivity towards providing referrals that are in the best interest of readers. Retirement Investments strives to keep its information accurate and up to date. The information on Retirement Investments could be different from what you find when visiting a third-party website.

Make all the right money moves!

When you sit down to do your 2017 taxes, you’ll be taking a nostalgia trip of sorts. The tax bill signed into law late last year eliminated some potentially valuable deductions starting in 2018. So your 2017 return may be your last chance to benefit from those write-offs, many of which are easy to overlook in the first place. Determining whether a worker is an employee or independent contractor can be complicated and the IRS makes the determination on a case-by-case basis. However, generally speaking, if a worker receives a W-2 statement showing wages paid and taxes withheld, he or she is an employee.

That's why we provide features like your Approval Odds and savings estimates. Aside from out-of-pocket health and dental costs, eligible medical expenses include home improvements related to health care, such as adding rails, grab bars or a stair lift. Deducting expenses for working from home can get complicated and an experienced financial advisor can be a great help.

An adjustment increase of $50 on the standard deduction of heads of households is done by the IRS in the 2017 tax year. A joint filing by married couples has generally lower tax rates compared to a separate filing. The standard deduction in 2016 for joint filing of married couples was $12,600. For 2017, the IRS had an increase of $100, thus, the standard deduction for joint filing of married couples is $12,700.

When using the direct method, you also need to account for depreciation of a portion of the house if you own it. You don't need to worry about calculating this when using the simplified method for taking the home office tax deduction. Divide the square footage of your home office by the square footage of your entire living space to calculate the percentage of your home that is dedicated to your home office. This percentage is then applied to your home expenses to determine what amount might be a business expense. Get live help from tax experts, plus a final review before you file — all free. In addition, you must have paid for more than half the household expenses for the year and file a tax return separate from your absent spouse.

Taking just any home office expense is no longer possible, but there are exceptions to be on the lookout for. We’ll break down these exceptions below to help you determine if you can take advantage of any. Our mission is to protect the rights of individuals and businesses to get the best possible tax resolution with the IRS. If you have a laptop sitting on your dining room table, that doesn't mean your dining room is now your "home office." It's still a dining room in the eyes of the IRS. This doesn't necessarily mean that your office needs to be a separate room -- just a defined space that is solely for business purposes.

The good news is that there are some tax deductions that you may be eligible for, that you wouldn’t be if you were doing the same job in an office space. Our Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they know it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid.

Business travel expenses are some of the most frequent work-related deductions. A taxpayer can use either the regular or simplified method to figure the home office deduction. You can claim a percentage of expenses such as rent, mortgage interest, utilities, insurance, and repairs. Depreciation is also an allowable expense for a home that you own. You should also save proof of payment for any tax-related expenditures. This proof may be in the form of a credit card or bank statement, canceled check, or itemized receipt.

If you’re an employee, you can claim certain job-related expenses as a tax deduction, but only for tax years prior to 2018. For tax year 2018 and on, unreimbursed expenses and home office tax deductions are typically no longer available to employees. For the 2017 tax year, the IRS allows individuals to take certain itemized deductions for expenses that exceed 2% of their adjusted gross income.

No comments:

Post a Comment